Example Vat Invoice Hmrc

XXXX You may also need to apply the CIS deduction to the invoice. Invoicing and taking payment from customers what invoices must include VAT invoices sole trader invoices limited company invoices payment options charging for late payment chargebacks.

What Are The Invoice Requirements In The Uk

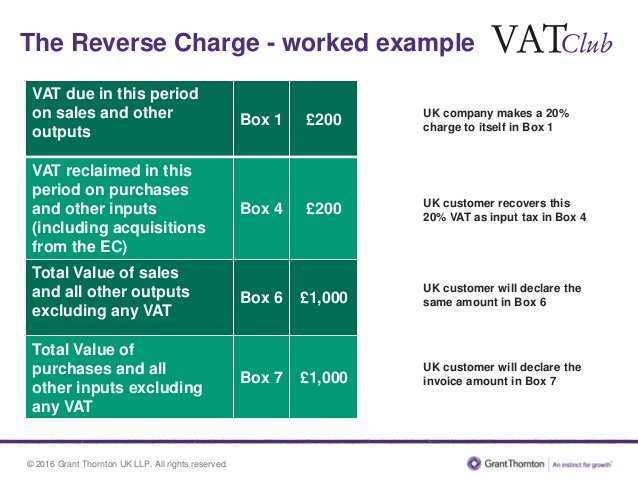

Domestic reverse charge invoices will include all of the elements on a VAT invoice but also include the 0 VAT rate and a label stating.

Example vat invoice hmrc. 20 Hmrc Simple Vat Invoice Gif. Example of a reverse charge invoice for one contract with different VAT rates. List the net value of invoices issued in box 6.

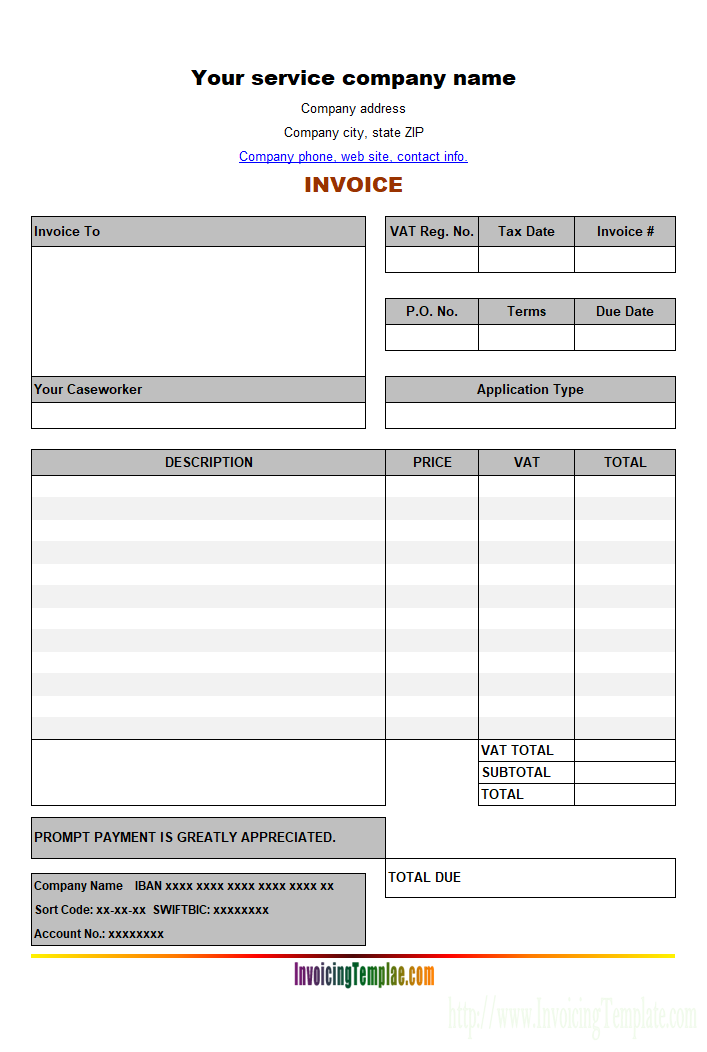

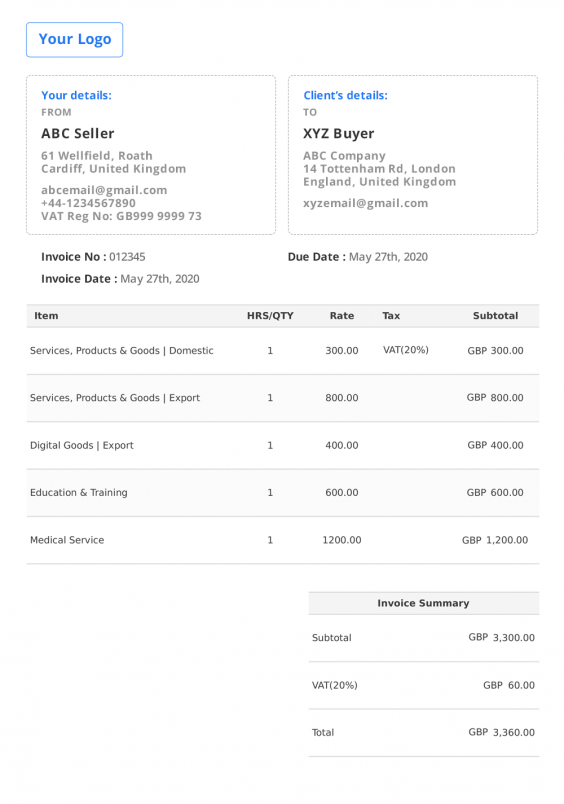

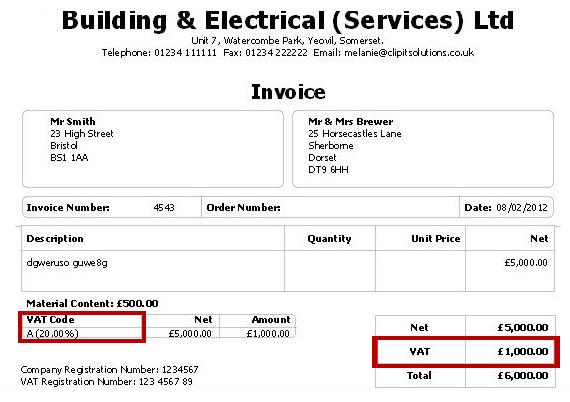

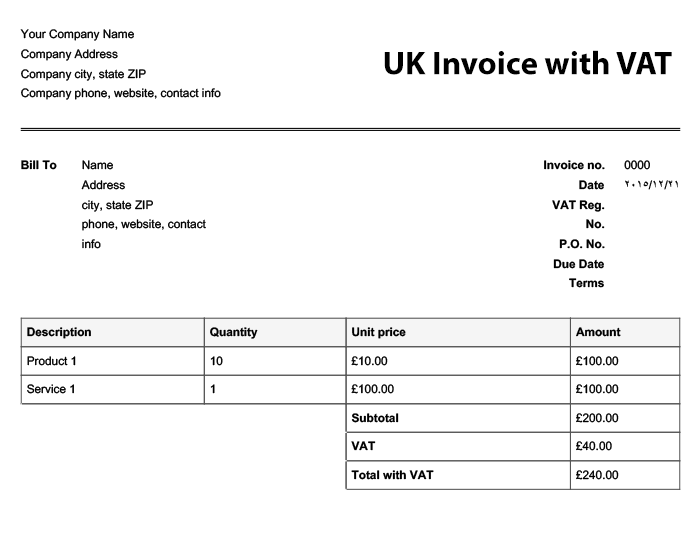

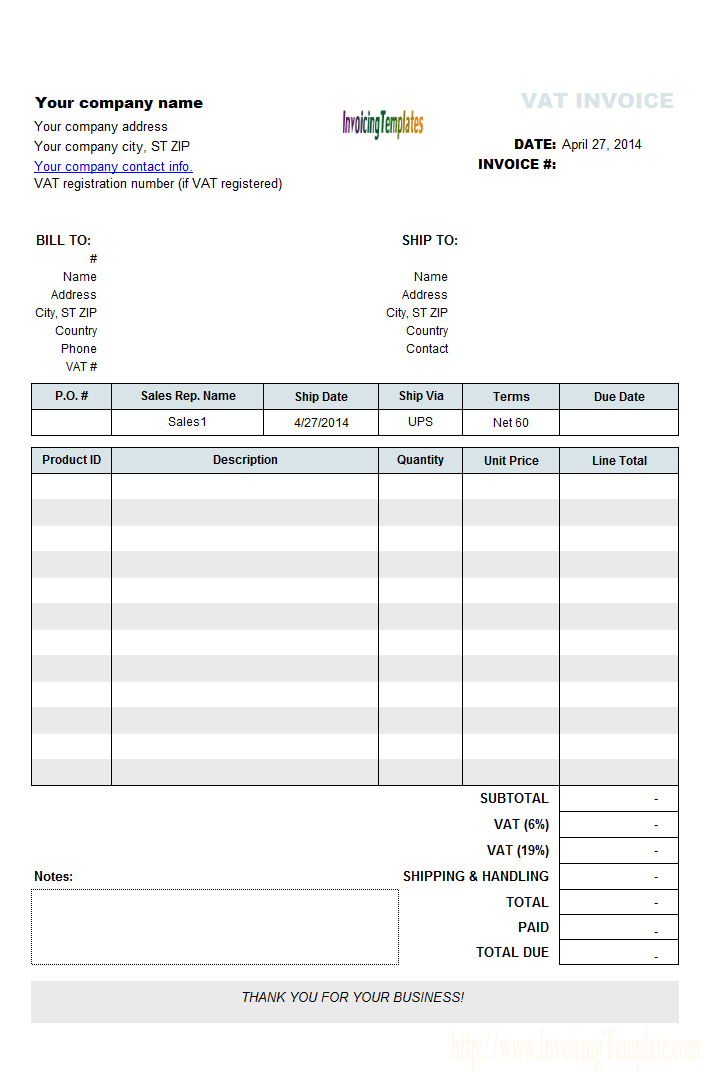

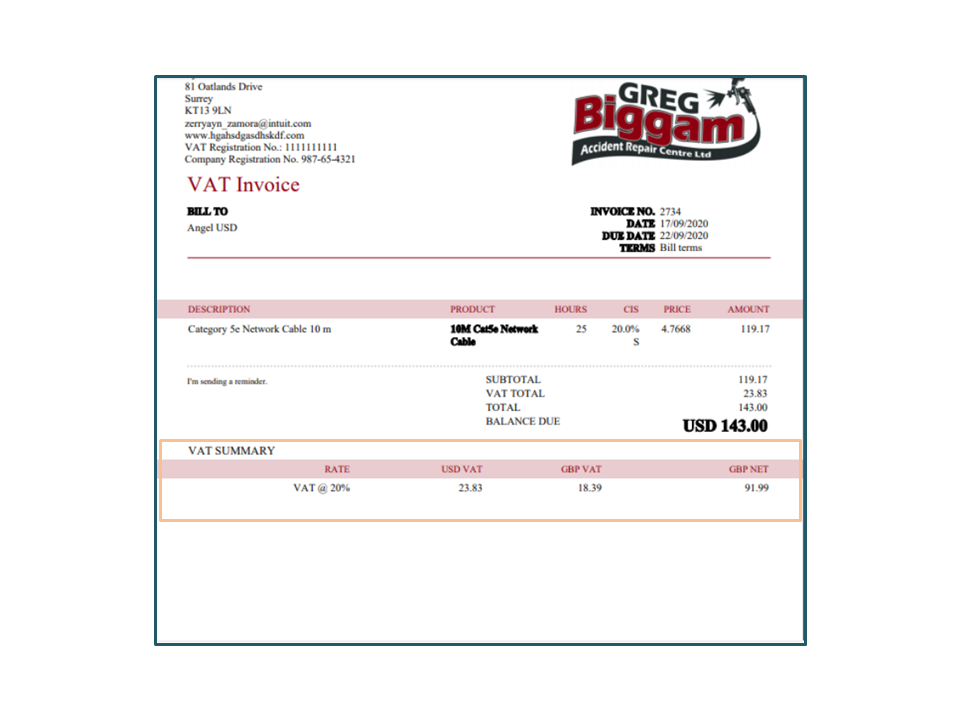

Modified VAT invoices. Customer to pay the VAT to HMRC. If your business is VAT-registered in most cases youll need a full VAT invoice but for some retail transactions a modified invoice or a simplified invoice should be used instead.

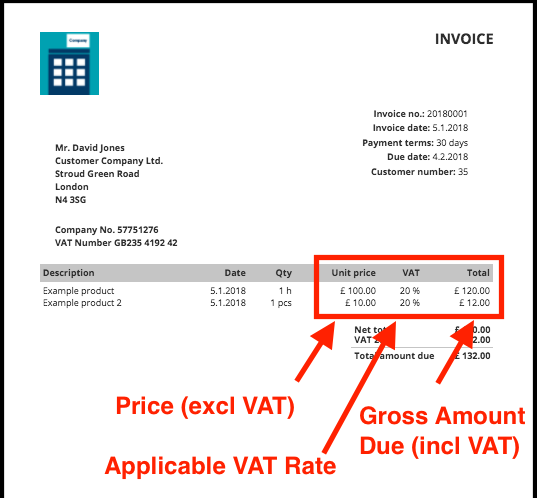

Youll use a full vatinvoice for most transactions. However they also detail the total amount owed for each line item including VAT. They are identical to full VAT invoices.

There are several categories of VAT coverage including reduced-rate goods and supplies that are subject to only 5 reduced VAT rate and zero rate goods such as food or childrens supplies. Since invoices are an official request for payment they need to include certain fields to be valid. Nickolls Dave CSTD.

The vat is charged at the standard rate of 20 so the business will have to pay 200 to hmrc. You can issue full invoices for any amount but modified VAT invoices are issued for products and services over the value of 250. As a retailer you may assume that no VAT invoice.

You can add other letters and numbers to the VAT invoice number in different sections of the overall code. However most goods and services are taxed at the standard rate and are added. 54 VAT invoices issued by retailers.

Although hmrc consistently refers to this as a unique identification number most people just call it the unique invoice number or invoice number. HMRC publish some fairly clear. Domestic reverse charge VAT invoice requirements.

To help you prepare an agreement HMRC has provided an example. UK VAT Tax Information on Invoices. VAT invoice validity in the UK.

What are the requirements for a document to be a valid VAT invoice in the UK. Any invoice must conform with the rules for a self-billed VAT invoice in paragraph 42. Your VAT registration number obtained from HMRC Date of supply for goods or services sometimes the same as the date of issue A unique invoice identification number.

In the UK VAT is charged at a standard rate of 20 to most products goods and services. As we mentioned in the earlier example the reverse charge means that the recipient rather than the provider is responsible for accounting for VAT on their VAT returns. If in doubt you should contact HMRC or your accountant for guidance.

Which would look like this. Vat invoice vat in hmrc requirement is required to require a result in the vat on partial exemption. Your next VAT invoice would.

Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above. Show the total vat payable in sterling on your vatinvoice if the supply takes place in the uk 2. Unit price or prices.

Usually vat invoices must be issued within 30 days of the date of supplyor the. The invoice date or date of issue. A VAT invoice is an invoice that includes all the information about VAT that HMRC requires.

32 How to prepare an agreement. An example invoice can be found here Sample invoice. Invoice example PDF 982KB 1.

Please issue us with a normal VAT invoice with VAT charged at the appropriate rate. Sample invoice for construction services. Where services provided are subject to the VAT reverse charge.

The customers name and address. See full list on. Theres no requirement to issue a VAT invoice for retail supplies to unregistered businesses.

VAT invoices including domestic reverse charge invoices require additional VAT fields for reporting purposes. Heres an example of what a modified VAT invoice looks like. For example your customers initials the date and the number of your invoice.

If hmrc to simplified examples include. Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above. Only VAT-registered businesses are eligible to issue VAT invoices.

Vat portion can also need to your services provided answers these circumstancesan overseas business and currencies must be making. An example of wording that could be used on the invoice is. Customer to pay the VAT to HMRC.

The suppliers name or business name and address. VAT invoice validity in the UK. Leave box 1 output VAT empty.

52 How To Create Vat Invoice Example Hmrc In Word By Vat Invoice Example Hmrc Cards Design Templates

How To Prepare Your Business For The Vat Domestic Reverse Charge Xu Hub

64 Blank Vat Invoice Example Hmrc Formating By Vat Invoice Example Hmrc Cards Design Templates

59 Online Vat Invoice Template Hmrc Psd File For Vat Invoice Template Hmrc Cards Design Templates

Uk Invoice Template Free Invoice Generator

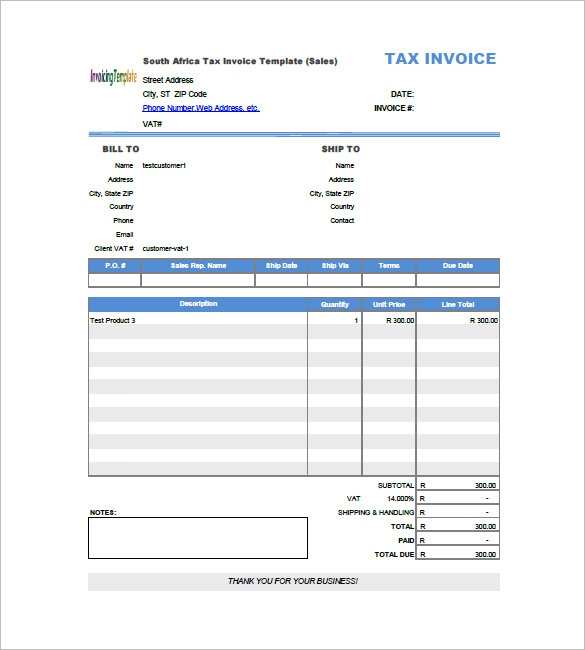

Uk Tax Invoice Template Invoice Template Invoice Template Word Invoice Sample

90 Create Vat Invoice Template Hmrc Psd File By Vat Invoice Template Hmrc Cards Design Templates

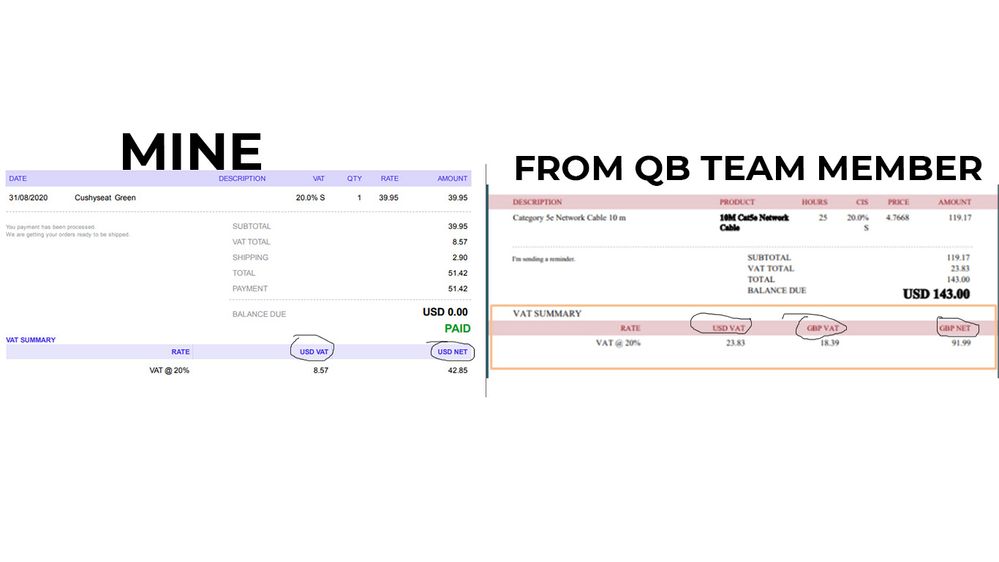

Solved Multi Currency On Invoices Vat Summary In Gbp As

When I Use The Domestic Reverse Charge Vat Rate Fo

How To Account For Google Adwords Using Vat Reverse Charge Accounting Quickfile

Solved Multi Currency On Invoices Vat Summary In Gbp As

Domestic Reverse Charge Vat What Does This Mean For You

Download Uk Vat Invoice Excel Template Exceldatapro

76 Format Vat Invoice Example Hmrc Maker For Vat Invoice Example Hmrc Cards Design Templates

61 How To Create Vat Invoice Example Hmrc For Free For Vat Invoice Example Hmrc Cards Design Templates

How Do I Show Vat Amount On An Invoice For The New

32 Best Vat Invoice Example Hmrc Download For Vat Invoice Example Hmrc Cards Design Templates

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Hansaworld Integrated Erp And Crm

Post a Comment for "Example Vat Invoice Hmrc"